Robin has been local to the Texas market for over 20 years and is a member of the Greater Houston Builders Association. For more information or to contact Robin, visit her at Cadence Bank.

That is the question these days. Many buyers try to “time the market.” A majority of prospective buyers (85%) have stated that when rates drop to 5.5 percent, they will enter the real estate market. That’s great news if you are a seller, but NOT great news if you are a buyer.

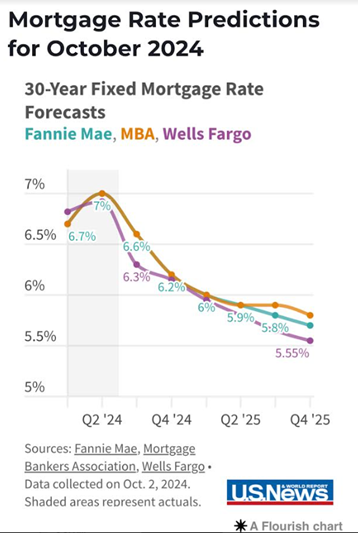

Below is a chart showing mortgage rate predictions courtesy of Fannie Mae, the Mortgage Bankers Association, and Wells Fargo.

This chart indicates mortgage rates will likely drop over the next 12 months. The lower the rates actually drop, the more people who will enter the real estate buying market.

Remember that real estate market when each listing had 10 offers – and most sold over list price? If all these buyers indeed jump back into the market when rates hit 5.5, then the time to buy is BEFORE they jump.

Some things to do that help buying now – and potentially refinance later.

A good lender will discuss these options and help you with a strategy that provides you with the most options now, allowing you to buy now and take advantage of lower rates later.

Remember – you can’t time the market – but you can work the market!

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.